Corporate Trendline Evaluation for 8558590047, 18664548855, 2105860016, 3921871690, 41104000, 29598777

The Corporate Trendline Evaluation for identifiers 8558590047, 18664548855, 2105860016, 3921871690, 41104000, and 29598777 presents a pivotal opportunity for organizations to assess their operational performance. By examining these metrics, firms can uncover essential insights into their market positioning and competitive landscape. This analysis not only highlights existing strengths and weaknesses but also sets the stage for informed strategic decisions that can enhance overall effectiveness. What implications might these findings hold for future business strategies?

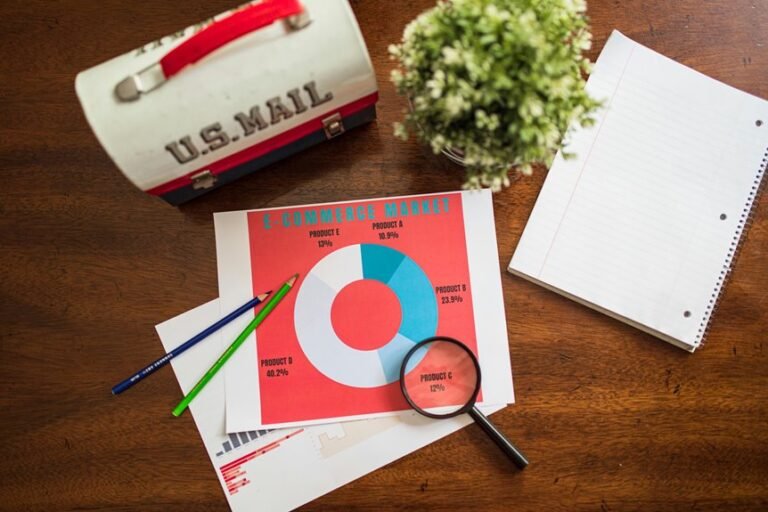

Performance Metrics Analysis

Performance metrics serve as critical indicators of organizational health and operational efficiency within a corporate context.

By establishing performance benchmarks, organizations can measure success against strategic goals. Efficiency metrics further allow for the identification of areas needing improvement, fostering a culture of continuous enhancement.

This analytical approach empowers businesses to optimize resources, enhance productivity, and ultimately achieve greater autonomy in their operational frameworks.

Market Behavior Insights

Understanding market behavior is essential for organizations seeking to navigate the complexities of consumer demand and competitive dynamics.

Analyzing market fluctuations reveals critical insights into consumer sentiment, enabling firms to adapt strategies effectively. By monitoring these shifts, businesses can harness opportunities, mitigate risks, and align offerings with evolving preferences, ultimately fostering resilience and stimulating growth in an ever-changing marketplace.

Comparative Trend Analysis

How can organizations leverage comparative trend analysis to enhance strategic decision-making?

By conducting trend comparisons, businesses can effectively evaluate performance across various metrics, identifying strengths and weaknesses relative to competitors.

This analytical approach provides insights that inform resource allocation and strategic initiatives.

Ultimately, comparative trend analysis empowers organizations to make informed decisions, fostering agility and responsiveness in a dynamic market landscape.

Strategic Implications for Businesses

Building on insights gained from comparative trend analysis, organizations can uncover significant strategic implications that directly impact their operational effectiveness and market positioning.

Effective business alignment facilitates resource optimization, while robust risk management enhances resilience against market fluctuations.

Conclusion

In conclusion, the Corporate Trendline Evaluation serves as a compass for organizations navigating the complex waters of market dynamics. By harnessing the insights gleaned from performance metrics, market behavior, and comparative trends, businesses can strategically position themselves to seize opportunities and mitigate risks. As the business landscape continues to evolve, those who remain vigilant and adaptable will not only survive but thrive, transforming challenges into stepping stones for sustainable growth.