Market Performance Synopsis on 8007775083, 4029324145, 299822911, 671628446, 8333712570, 974355208

The market performance of identifiers such as 8007775083, 4029324145, 299822911, 671628446, 8333712570, and 974355208 reveals intricate patterns of volatility and investor behavior. Recent fluctuations suggest a shift towards stability and diversified strategies. As economic conditions evolve, these identifiers exhibit varying resilience, prompting a closer examination of their comparative performance. Understanding these dynamics could illuminate potential investment pathways in an increasingly complex landscape. What implications might these trends hold for future investment strategies?

Overview of Identifiers and Their Significance

Identifiers play a crucial role in market performance analysis, serving as essential tools for categorizing and tracking various financial instruments.

Their significance lies in enhancing transparency and enabling investors to make informed decisions.

By providing clarity on asset classifications, identifiers influence market implications, fostering an environment where stakeholders can assess risks and opportunities effectively.

Ultimately, this contributes to more efficient market dynamics.

Recent Performance Trends

How have recent market performance trends shaped investor behavior?

Performance indicators reveal that increased market fluctuations have led to heightened volatility, prompting investors to reassess risk tolerance.

As uncertainty looms, many are shifting towards more conservative investment strategies, focusing on stability rather than aggressive growth.

This trend reflects a broader response to changing economic conditions, highlighting the adaptability of investors in navigating unpredictable markets.

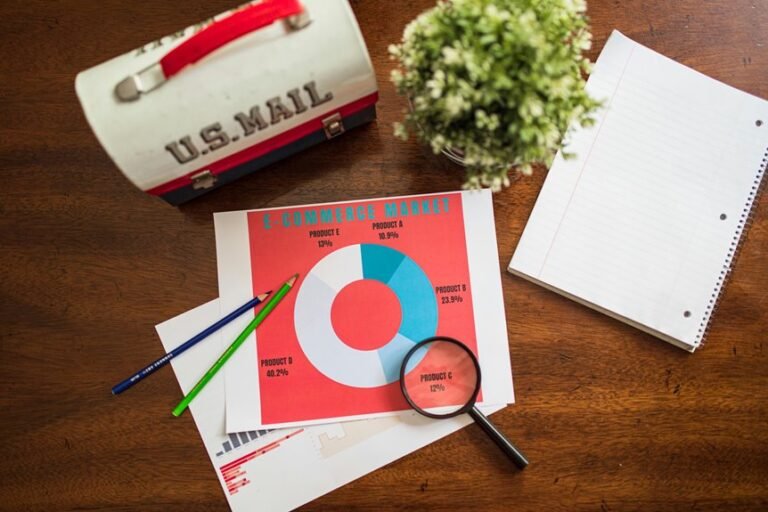

Comparative Analysis of Market Dynamics

While market dynamics can vary significantly across different sectors, a comparative analysis reveals underlying patterns that inform investor strategies.

Market volatility often correlates with key economic indicators, highlighting the importance of understanding the competitive landscape.

Such insights enable investors to align their portfolios with industry benchmarks, enhancing resilience against fluctuations and optimizing performance across diverse market conditions.

Future Projections and Investment Considerations

As global economic conditions continue to evolve, future projections for market performance necessitate a thorough analysis of emerging trends and potential investment strategies.

Investors must prioritize risk assessment, balancing opportunities against inherent uncertainties. By identifying sectors poised for growth and employing diversified investment strategies, individuals can navigate the complexities of the market, enhancing their potential for sustainable returns while mitigating financial exposure.

Conclusion

In conclusion, the market performance of identifiers like 8007775083 and 4029324145 reveals a landscape marked by volatility, akin to navigating a stormy sea. Investors must remain vigilant, employing robust analysis and risk assessment to chart a course through these turbulent waters. As strategies shift towards stability and diversification, aligning with industry benchmarks becomes imperative for optimizing portfolio performance. The future holds both challenges and opportunities, necessitating a proactive approach to investment decisions in an ever-evolving market.